The European Union's external balance continued to deteriorate at the end of the year, with official data showing a narrower trade surplus as exports — especially in machinery, vehicles and chemicals — lost momentum. The decline underscores mounting pressure from shifting trade relations with the United States and intensifying competition from Chinese imports.

EU trade figures for December show the surplus fell to 12.9 billion euros, down from 13.9 billion a year earlier. Machinery and vehicle shipments, which have been the principal drivers of export growth for several years, recorded further declines, and chemical exports also contracted.

Trade flows to the bloc's largest external partner, the United States, weakened markedly. Exports to the U.S. were down 12.6% year on year, a fall that reduced the EU surplus with that market by roughly a third to 9.3 billion euros. At the same time, the union's deficit with China widened to 26.8 billion euros from 24.5 billion euros.

Observers point to two interlinked forces behind these moves. First, tariffs introduced by the United States in early 2025 have coincided with volatile export patterns; when that volatility is smoothed, the underlying trend shows distinctly lower sales. Higher prices resulting from tariffs appear to be prompting some U.S. importers either to cut orders or to source goods from alternative suppliers. Second, rising Chinese imports are crowding out domestic production in sectors where the EU has relied on strong external demand.

Economists cited in the data release warn that recovering lost share in the U.S. market will likely take years. That gap is significant because net exports have been a central element of euro zone growth. Faced with these headwinds, the euro area now faces prospects of expansion running barely above 1% per year for an extended period.

Despite these external challenges, domestic economic activity is showing resilience. Investment tied to artificial intelligence and stronger household consumption have begun to pick up, helping to sustain modest GDP growth. Eurostat's separate release covering the final quarter of 2025 reported 0.3% expansion in the euro zone, matching preliminary estimates.

Labour market indicators also point to stability. Employment in the euro zone rose by 0.2% over the previous quarter, maintaining the rate seen in the three months before that.

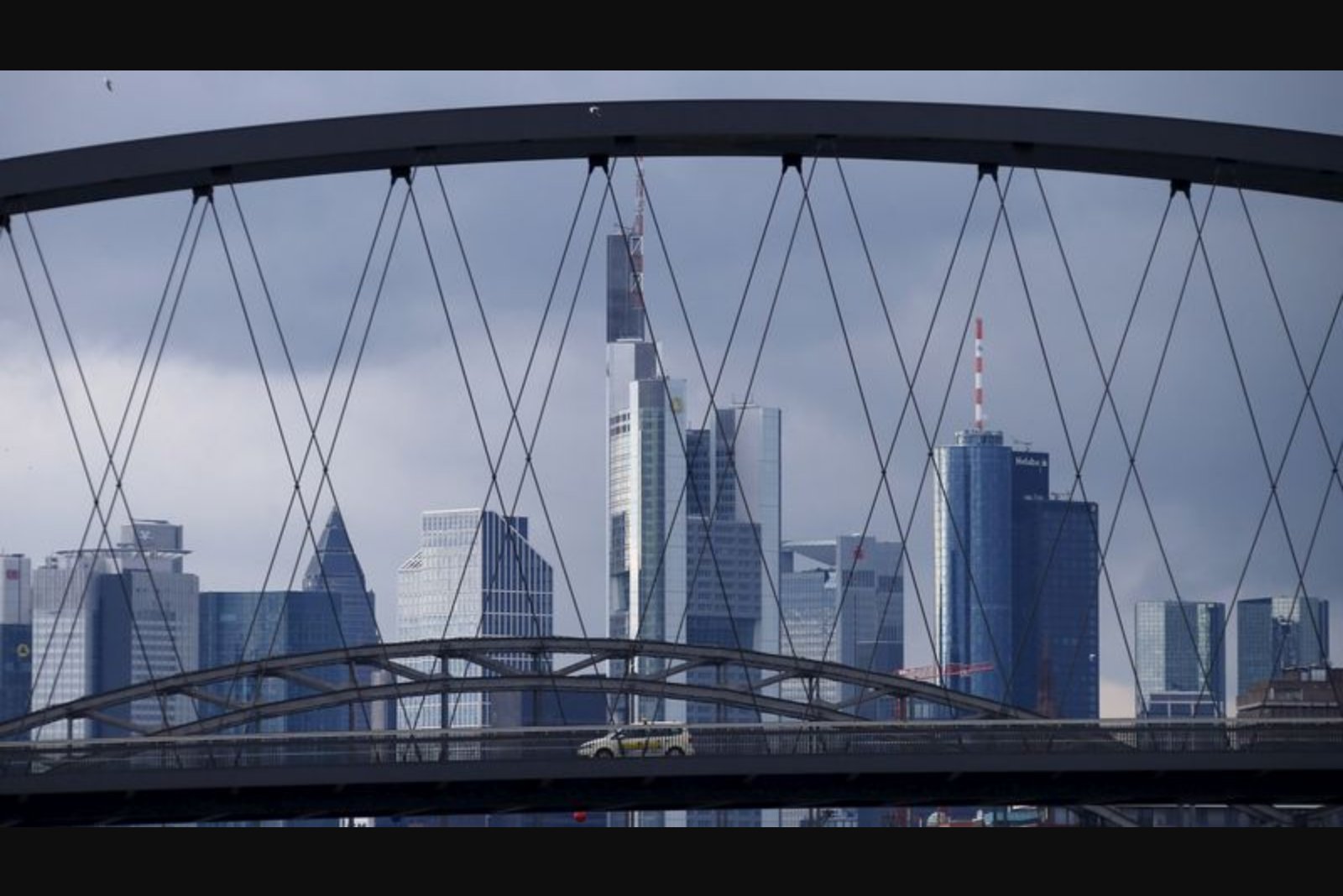

National fiscal moves are contributing to the domestic cushion. In Germany, government plans to increase investment in defence and infrastructure - areas that have been underfunded in past years - are intended to lift activity. Officials expect spending to be slow to ramp up but to begin supporting second-quarter figures and to reach full effect by the end of the year.

European leaders have recently convened to explore policy responses to what they described as aggressive economic rivalry from the U.S. and China. The European Central Bank has suggested that dismantling external barriers could, over time, help recapture trade lost to U.S. tariffs.

For now, the combination of weakening external demand and stronger domestic engines leaves the euro zone in a mixed position: trade positions are deteriorating, but internal investment and consumption are helping to prevent a sharper slowdown.

Data highlights

- EU trade surplus: 12.9 billion euros in December, down from 13.9 billion a year earlier.

- Exports to the U.S.: down 12.6% year on year, reducing the U.S. surplus to 9.3 billion euros.

- Trade deficit with China: 26.8 billion euros, up from 24.5 billion euros.

- Euro zone GDP: 0.3% growth in the final quarter of 2025, per Eurostat.

- Employment: rose 0.2% over the previous quarter.