Overview

Rosenblatt Securities has reaffirmed a Buy rating on Applied Optoelectronics Inc. (NASDAQ:AAOI) and left its price target at $50.00 ahead of the company’s fiscal fourth-quarter earnings report, scheduled for Thursday, February 26 after the market close. The $50.00 target implies about a 15% upside from the share price of $43.44 quoted in the data cited, even as InvestingPro data suggests the stock may be trading above its Fair Value. The shares have exhibited strong recent performance, rising 91% over the past six months and 59% over the last year.

Rosenblatt’s Q4 and near-term revenue expectations

Rosenblatt projects Applied Optoelectronics will report fourth-quarter fiscal 2025 revenues of approximately $133 million, which would be roughly $14 million higher sequentially. The firm expects that the quarter will include a nearly $20 million decline in CTV revenues to just over $50 million, attributing that decline to tightened spending by Charter during the period. Despite the CTV drag, the firm sees AAOI’s revenue trajectory as robust, noting a 101% increase in revenue over the last twelve months in InvestingPro data and analysts’ consensus forecasting about 82% growth for fiscal 2025.

Amazon contribution and product mix

Rosenblatt models a sharp lift in Amazon-related revenue, projecting growth from roughly $3 million in the third quarter of fiscal 2025 to about $33 million in the fourth quarter. The firm breaks that expected Amazon contribution down to roughly $8 million from 800G products and $25 million from 400G products. Rosenblatt also expects roughly $3 million of the sequential gain to come from legacy 100G and 400G products and Telecom products.

Guidance and Q1 fiscal 2026 outlook

Looking forward, Rosenblatt anticipates that Applied Optoelectronics could guide first-quarter fiscal 2026 revenue above the consensus estimate of $146 million. The firm cites continued sequential increases across CTV, Amazon 400G and Amazon 800G sales as the drivers of that potential upside. Rosenblatt’s model estimates Amazon could contribute approximately $60 million of revenue in the first quarter, composed of about $25 million from 800G products and $35 million from 400G products.

Profitability, balance sheet and volatility

Despite the top-line momentum, InvestingPro data indicates analysts do not expect AAOI to be profitable this year, with an EPS forecast of -$0.33 for fiscal 2025. Rosenblatt highlights the company’s financial posture, noting a moderate debt level with a Debt/Equity ratio of 0.42 and healthy liquidity signaled by a current ratio of 2.31. The firm also flags the stock’s high volatility and premium valuation as considerations for investors.

Product developments and order flow

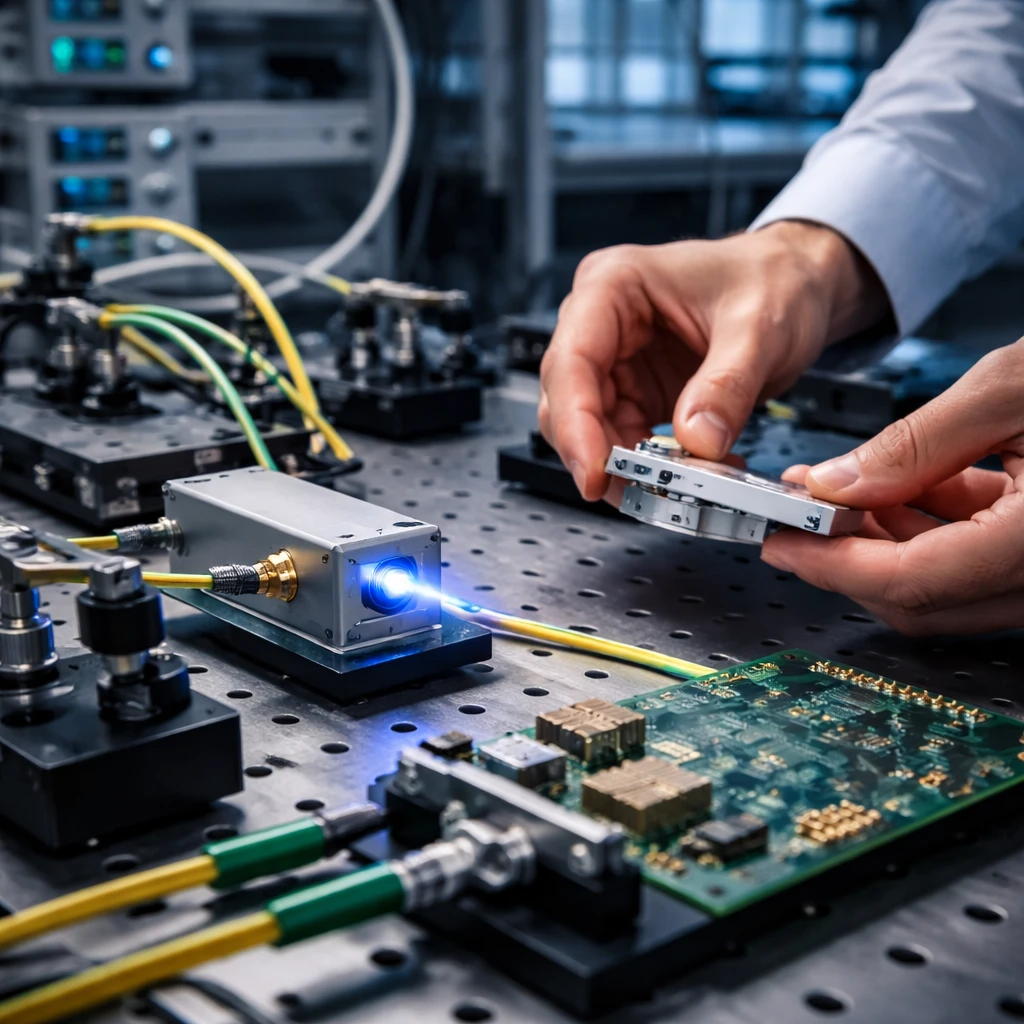

Applied Optoelectronics recently launched a 400-milliwatt narrow-linewidth pump laser targeted at silicon photonics and co-packaged optics applications in AI data centers. The company positions the product as addressing performance limits in existing systems by providing a direct light source for semiconductor chip-scale systems. In addition, the company announced it received its first volume order for 800G data center transceivers from a major hyperscale customer. That order is expected to add between $4 million and $8 million to total revenue in the fourth quarter and supports the company’s plan to meet its 800G shipment expectations by year-end.

Analyst reactions

Following the 800G transceiver order announcement, Rosenblatt raised and maintained its $50 price target and held a Buy rating. Needham also responded positively, raising its price target to $43 and maintaining a Buy rating, citing successful qualification of the 800G transceiver technology. Both firms framed their updates as evidence of growing confidence in AAOI’s position in the AI data center optics market.

Note on data and valuation

InvestingPro figures referenced in these expectations show strong historical revenue growth and current analyst forecasts; however, those same sources indicate the company is not expected to return to profitability in fiscal 2025. Rosenblatt continues to designate Applied Optoelectronics as a Top Pick on the prospect of multi-year participation in the Data Center AI transceiver cycle, while also acknowledging balance sheet strengths, product momentum and market volatility.